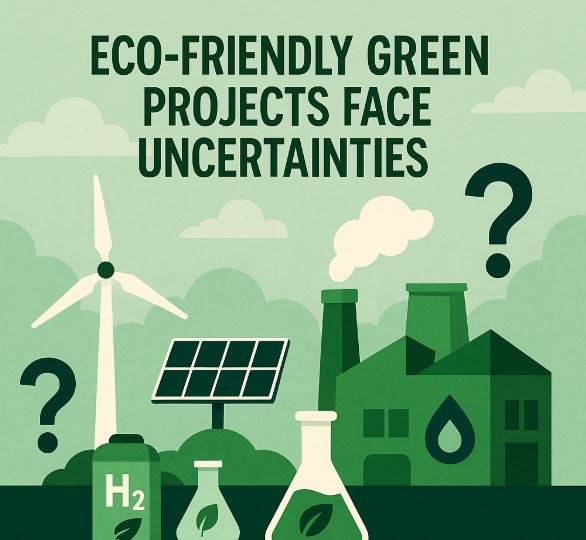

ECO FRIENDLY GREEN PROJECTS FACE UNCERTAINTIES N.S.Venkataraman

Globally, in all discussions on energy and environmental issues, the consensus view is that the ultimate solution would be the augmentation of renewable energy production capacity and development of eco friendly green projects such as green hydrogen, green ammonia, green methanol and so on as rapidly as possible. Expectation is that such green projects would reduce harmful emission such as carbon dioxide, sulphur dioxide, nitrous oxide by eliminating the use of fossil fuel. Certainly, this view is appropriate.

Several countries have announced pilot projects for production of green hydrogen, green ammonia and green methanol, with considerable focus on fine tuning of the process technology parameters and optimizing cost of production.

Overview on green hydrogen

As is known, hydrogen is classified as brown hydrogen when produced from coal, grey hydrogen when produced from crude oil and natural gas, green hydrogen when produced by water hydrolysis and blue hydrogen which involves carbon capture.

At present, most of the hydrogen produced today in the world comes from steam reforming of fossil fuels, which is known as grey hydrogen. In China, hydrogen is also produced from coal in considerable quantity, which is known as brown hydrogen.

Eco friendly green hydrogen can be an important source for energy , transportation fuel and serve as feedstock for the production of several products such as green ammonia, green methanol and so on. The use of green hydrogen can eliminate emission and alleviate the impending crisis due to global warming and consequent possible natural hazards such as melting ice, rise of sea level, climate variation etc.

Electrolyzer technology for green hydrogen production

Efforts to finetune electrolyser technology to produce green hydrogen by water electrolysis is underway all other the world, which is the key requisite to reduce the production cost of green hydrogen.

Several technologies exist for its production of green hydrogen.

The most established one is the alkaline water electrolyser (AWE), which uses a potassium hydroxide (KOH) alkaline electrolyte. Other technology namely the proton exchange membrane electrolyser (PEMEL) is the popular technology, as it can integrate well with renewables and follow their profile ramping production up or down within minutes. Other technologies include the solid oxide electrolyser (SOEL), utilizing a ceramic electrolyte and the anion exchange membrane electrolyser (AEMEL), which aims to merge the advantages of AWE and PEMEL.

R & D efforts are now focused to produce green hydrogen in microbial electrolytic cells, where electrochemically active microbes grow on anodes and oxidize organic matter. The catalysis steps require expensive materials such as platinum, iridium, etc. it is reported that Jawaharlal Nehru Centre for Advanced Scientific Research in India has designed nickel-nickel hydroxide – graphite electrodes with a water splitting capability comparable to platinum electrodes.

Proposed electrolyser projects in India

In May 2022, GAIL awarded contract to build green hydrogen project using a Proton Exchange Membrane (PEM) electrolyser technology in the Guna district of Madhya Pradesh.

In December 2021, GAIL announced that it would commission 10 MW of electrolyser capacity to produce 4.3 tonne of green hydrogen per day.

Indian Oil Corporation is setting up a 100 kw electrolyser plant to manufacture green hydrogen at its Jorhat oil field in Assam.

National Thermal Power Corporation (NTPC) is developing hydrogen-to-electricity project using US-headquartered Bloom Energy’s solid-oxide electrolysers and fuel cell technology. NTPC’s floating solar plant will power the electrolysers to produce green hydrogen. Bloom Energy’s hydrogen fuel cell technology will convert the hydrogen into carbon-neutral electricity.

In April 2022, Gujarat Industries Power Company Limited (GIPCL) issued an expression of interest to set up 5 MW to 10 MW electrolyser capacity for green hydrogen project and associated facilities in Gujarat.

The green hydrogen powered train developed by Indian railways will rely on hydrogen produced in a 1-MW polymer electrolyte membrane electrolyser, developed by Jind, Haryana, that produces 430 kg of hydrogen every day.

Proposed green hydrogen projects in India :

Several companies have made a flurry of announcements about setting up projects for producing green hydrogen.

Reliance Industries announced capital outlay of Rs.75,000 crore over the next three years to develop manufacturing capacities for clean energy technologies, which include green hydrogen production.

In April 2022, ReNew Power announced a joint venture with Indian Oil Corporation and Larsen & Toubro for green hydrogen project.

Indian Oil Corporation targets green hydrogen production of 70,000 tonne annually by 2030.

Adani Group and French oil and gas company TotalEnergies announced a partnership to invest US$50 billion in 10 years to produce green hydrogen.

In September 2025, green hydrogen pilot project was inaugurated at the VOC Port in Thoothukudi, thus making it the first port in India to produce green hydrogen. Established at a cost of Rs.3.87 crore, the project will generate green hydrogen to power streetlights and an electric vehicle charging facility in the port colony, and a 400 KW rooftop solar power plant at a cost of Rs.1.46 crore taking VOC Port total rooftop solar capacity to 1.04 MW.

The Indian railways recently announced that a hydrogen powered train, developed at the Integral Coach Factory in Chennai, has successfully completed all tests. Hydrogen will refill fuel tanks on the train, where fuel cells will convert the hydrogen to electricity that runs the trains’ electric motors.

Production cost of green hydrogen

The production cost of brown hydrogen is currently around USD 2.20 per kg. The production cost of blue hydrogen ydroigen Production cost of bludTT can be as low as USD 1.5 per kg in certain regions. The production cost of green hydrogen range from USD 3.50 USD per kg and above, with significant portion of the cost of green hydrogen being the price of renewable electricity.

It is reported that around 50% of the global hydrogen production is priced under 2.5 USD per kg.

In India, grey hydrogen produced from natural gas costs roughly Rs.150 to 200 per kg, with costs dependent on natural gas price.

In India, the present production cost of green hydrogen is around Rs.350 to 450 per kg.

Reliance Industries Limited aims to reduce the production cost of green hydrogen below USD 1 per kg by the end of this decade. The company is developing electrolyzer technology.

It remains to be seen as to what extent the production cost of green hydrogen can be reduced, to ensure that the green hydrogen would be priced competitively with the available grey hydrogen in India, which is at present priced much lower than that of green hydrogen.

Proposed green ammonia / green methanol projects in India

Sembcorp proposes to produce green ammonia in Tuticorin. The plant will initially produce 200,000 tonne per annum of green ammonia for exporting.

ACME Solar, an ACME Group company, has commissioned pilot plant of an integrated green hydrogen and green ammonia production facility in Bikaner, Rajasthan.

In June 2022, ACME Group signed a memorandum of understanding with the Karnataka government to develop an integrated solar to green hydrogen to green ammonia facility worth Rs.52,000 crore. The facility will produce 1.2 million tonne per year of green hydrogen by 2027 in Karnataka.

Gujarat Alkalies and Chemicals Limited signed MoU with NTPC to set up green ammonia and green methanol plants.

The foundation stone for a pilot green methanol bunkering and refuelling facility costing Rs.35.34 crore was laid at VOC Port in Thoothukudi, with a capacity of 750 m3.

Status of ammonia industry in India

Production process for anhydrous ammonia involves combining nitrogen and hydrogen under high temperature and pressure with a catalyst to produce ammonia.

At present, practically, all ammonia is produced using hydrogen, that is produced from fossil fuels (natural gas and coal) in the world.

Annual installed capacity in India : 19.8112 million tonne

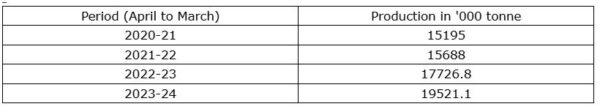

Indian production

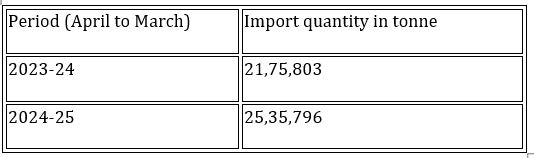

Annual import

India is net importer of large quantity of ammonia, as production in India is far less than the Indian demand.

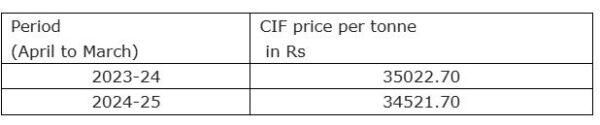

Average annual CIF price of imported ammonia

Status of methanol industry in India

Methanol is produced industrially by the catalytic conversion of synthesis gas (syngas), a mixture of hydrogen and carbon monoxide (or carbon dioxide), under high pressure and moderate temperatures.

Ammonia provides the necessary hydrogen and nitrogen for methanol synthesis in some processes.

Indian production

At present, only Assam Petrochem Chemical is in operation for the production of methanol. Other units have stopped production of methanol due to lack of price competitiveness with the delivered price of imported methanol.

Indian production of methanol : Around 1,22,240 tonne per annum

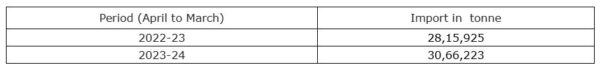

Indian import

India is net importer of large quantity of methanol, as production in India is far less than the Indian demand.

CIF price trend of imported methanol : Around Rs.25 per kg

Why uncertainty about green hydrogen project ?

Availability of renewable power

To produce one tonne (1,000 kg) of green hydrogen via water electrolysis, it requires approximately 50 to 55 MWh of electricity, which translates to about 50–55 kWh/kg of green hydrogen.

Power requirement for green hydrogen project should be met from renewable energy source such as solar and wind power and not from power produced from fossil fuel.

Government of India’s target is to reach 500 GW of installed electricity capacity from renewable sources by 2030. The target of 250 GW has already been achieved. The average capacity utilisation of renewable power project in India is only around 20% due to seasonal and other factors, in other words, out of 500 GW renewable power target, only 100 GW of green power would be effectively produced.

This level of renewable energy production will not be adequate to meet the power requirement of targeted green hydrogen production. Using power from fossil fuel for the production of hydrogen by water electrolysis process means that it would not be ecofriendly green hydrogen.

Production cost of green hydrogen

India currently consumes approximately 5 to 6 million tonne per annum of hydrogen, predominantly grey hydrogen.

The production cost of green hydrogen is much higher than the sale price of grey hydrogen in India at present.

It is extremely uneconomical for the hydrogen consuming industry to switch over to green hydrogen from grey hydrogen, in view of the price factors ?

Why uncertainty about green ammonia and green methanol projects ?

Requirement of hydrogen for ammonia production

To produce 1 tonne of ammonia, approximately 0.824 tonne of hydrogen is required.

To produce 1 tonne of methanol, approximately 180 to 200 kg of hydrogen is required. The exact amount may vary slightly depending on the specific technology used and the efficiency of the process.

To produce 1 tonne of methanol, approximately 0.25 to 0.3 tonne of ammonia is required, depending on the specific process.

Obviously, cost of production of hydrogen has major share in the production cost of ammonia and methanol.

Since the price of green hydrogen is much higher than price of grey hydrogen produced from natural gas, it would be totally uneconomical to produce green ammonia and green methanol using green hydrogen as input.

India is large importer of ammonia and methanol and Indian green ammonia and green methanol units have to compete in price terms with the imported price of ammonia and methanol, which are largely produced from grey hydrogen abroad. This appears to be not possible , in view of the higher production cost of green hydrogen.

Prognosis

The green ammonia and green methanol eco system will have to wait until such time the production cost of green hydrogen would be on par with the production cost of grey hydrogen. At present, setting up green ammonia and green methanol project is similar to the act of putting cart before the horse.

While efforts are being made to reduce production cost of green hydrogen, particularly aided by the recent trend of lowering renewable power price in India, it is difficult to estimate as to when and how the cost of production of green hydrogen would be lowered to the price level of grey hydrogen.

Certainly, the demand for green hydrogen is not a matter of concern. The matter of concern is the cost of production of green hydrogen.

Indian government launched the National Green Hydrogen Mission in January 2023 with a ₹19,744 crore outlay and a target to produce 5 million tonne of green hydrogen annually by 2030. India’s green hydrogen policy offers many incentives for setting up a green hydrogen facility. These incentives include single window clearance for faster project approvals and others. However, offer of incentives to promote green hydrogen projects, in the absence of competitive production cost of green hydrogen, will not take the green projects any where.

There are no significant movements on the ground related to these announcement regarding green projects, as investors seem to be keeping the fingers crossed with announcements not being quickly followed by active measures for implementation.

It would be appropriate that projects for green ammonia and green methanol are not encouraged in India, until such time that a breakthrough would be made in reducing the production cost of green hydrogen.