NOEL NEWS

Special Bulletin

The journey of a thousand miles

begins with a single step.

LAO TZU

Good morning, this is a special early bulletin, sent ahead of the usual July newsletter—which will land in your inbox in about a week and be the full, jam-packed edition you’ve come to expect.

I’ve brought this one forward for a simple reason: there’s a very special webinar coming up on Tuesday 8 July, and I didn’t want you to miss out.

Timing’s been a bit tricky—my podcast partner John Deeks isn’t free until Wednesday 2 July, and waiting for him would’ve meant telling you about the webinar far too late. I know how much many of you enjoy the events I’m involved in, so I wanted to make sure you had plenty of notice.

I’m also telling you about an event in Brisbane on the 23 July and flagging a seminar to be held in the eastern suburbs of Sydney in September.

The Senior Webinar

How to manage your money in retirement

Tuesday July 8, 2pm AEDT

If you click on this link, you’ll find all the information about it.

I hope you can join us.

The 2025 GemLife Over-50s Lifestyle Forum

Wednesday 23 July

If you’re looking to make the most of life after 50, the 2025 GemLife Over-50s Lifestyle Forum is not to be missed.

Taking place at Brisbane’s Victoria Park Golf Club in Herston, this free, half-day event brings together a panel of expert presenters including Noel Whittaker, Rachel Lane, and Carly Barlow, with Jamie Durie as MC.

The forum will cover key topics relevant to the over 50s, including financial wellbeing, downsizing, health, and lifestyle planning – all designed to help you make smart, informed choices for the years ahead.

Full details can be found by clicking on gemlife.com.au/forum and you could also book seats there – remember seats are limited.

If you can’t attend in person, register for the post-event recording by emailing sarka@gemlife.com.au.

https://www.gemlife.com.au/events/over-50s-lifestyle-forum-2025/

Proposed seminar in Sydney’s eastern suburbs

Thursday 11 September

A couple of months ago, Rachel Lane and I ran four packed-out seminars across Sydney’s Northern Beaches.

Now we’re getting strong interest from the eastern suburbs. I floated the idea with Shadforths—a national firm with a 100-year history and a focus on comprehensive financial advice—and they’re keen to partner with us.

We’re planning an event from 6pm to 8.30pm on Thursday 11th September. The only unknown is numbers—and that affects the venue.

If you think you might like to attend, please email noel@noelwhittaker.com.

There’s absolutely no obligation—we’d just appreciate your help with planning.

| Email Noel expression of interest |

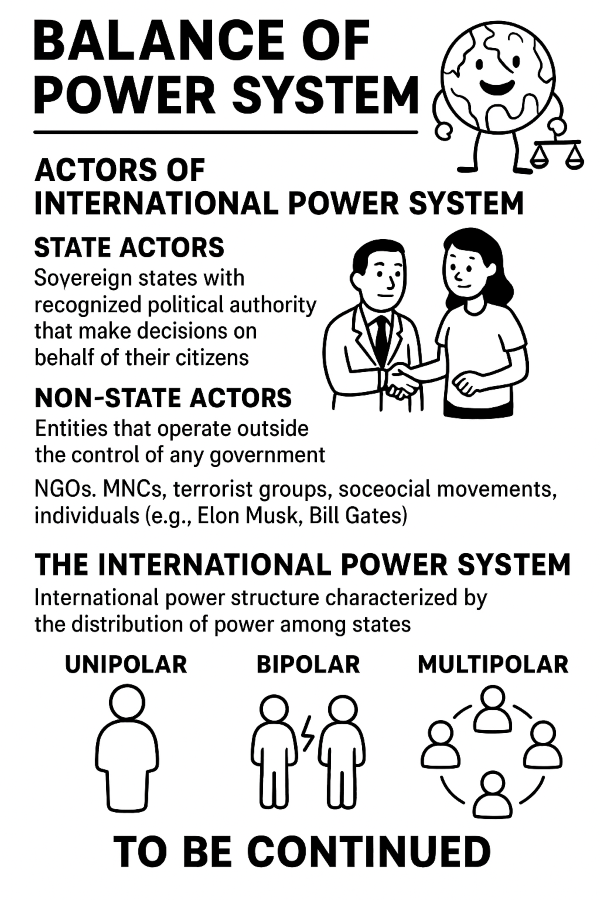

Questions on the new Division 296 tax

Labor’s attempt to tax unrealised capital gains in super has resulted in an avalanche of emails. Today we’ll look at some of the most asked questions.

Image by tartila on Freepik

Question

Regarding the proposed extra tax on earnings for super balances over $3 million – I agree taxing unrealised capital gains is a major concern and a complete shift from established principles. I thought any tax paid on unrealised gains would at least offset CGT when the asset is sold. But your article says otherwise:

“When you do eventually sell those assets and realise a profit, you will pay capital gains tax. And no, there is no credit for the tax you have already paid on the unrealised gains …”

Is that really correct? Surely there must be either a credit for tax already paid, or at least a cost base adjustment for the amount taxed.

Answer

You need to keep in mind that the tax on unrealised capital gains is calculated by taking the difference between the opening and closing values—adjusted for withdrawals and contributions for the financial year ending 30 June 2026. This is simply a method of calculation. It does not alter your cost base for capital gains tax purposes.

In other words, when assets in your fund are eventually sold, normal CGT rules will still apply. Taxation of specific assets within your fund is an entirely separate issue from the government’s decision to levy a tax on the difference in valuations.

Question

I understand the Transfer Balance Cap (TBC) is $1.9 million for 2024–25, increasing to $2 million from 1 July 2025.Amounts transferred above this cap are taxed at 15%. Given this, individuals with $3 million in the accumulation phase already face a 15% tax on earnings.

If the government’s proposed legislation passes, will it impose an additional 15% tax on earnings above $3 million, effectively bringing the tax rate to 30%? Or will the new tax apply only to the portion of the super balance exceeding $3 million that remains in accumulation? Additionally, how does this proposed tax interact with the existing lifetime TBC?

Answer

The transfer balance cap is simply a mechanism to limit how much can be transferred into pension phase within superannuation. It’s unaffected by the proposed changes. An example may help: suppose you have $3.6 million in super—$2 million in pension phase and $1.6 million in accumulation—at 30 June 2026. If your total balance then rises to $4 million, the increase is $400,000. However, only $1 million is above the $3 million threshold, so just 25% of the gain is taxable. That means the proposed tax of 15% would apply on $100,000, resulting in a $15,000 tax bill.

Question

I’m concerned about the proposal to tax unrealised capital gains in my super. If the fund holds franked shares, my understanding is that franking credits are refunded because tax has already been paid at the company level. If so, how can a franking refund be included in the year-end balance as a “contribution”? Shouldn’t it be excluded from the new tax calculation?

Answer

That’s not quite how franking works. When a fund receives a franked dividend, the statement shows the cash dividend and the franking credit. The credit isn’t a contribution—it’s a tax offset that forms part of taxable income. It’s used to reduce tax payable, and any excess is refunded. These amounts either boost the fund’s bank balance or reduce its tax, improving its net position. It’s not double taxation—it’s what prevents it

From the mailbox

Image by Bob Rich for Hedgeye

Question

With global political unrest threatening a potential market downturn, should we hold our share portfolio or shift a significant portion to term deposits?

We’re a retired couple, aged 79 and 76, and have been retired for 16 years. Our assets include an $805,000 share portfolio generating about $40,000 a year, $177,000 in combined super earning roughly 6% annually, and $15,000 in the bank. We also own cars, a caravan, and our home. We’re in good health and still active.

Answer

I appreciate that we’re in interesting times – and naturally, any conflict of the current magnitude generates massive headlines. Just remember, the share market has always had a long-term upward trend, and the secret of success is staying in and riding out the normal volatile periods. When you own shares, you’re investing in businesses, and there’s no doubt whatsoever that the major businesses making up the world’s stock exchanges will continue to prosper over the long term.

You may well have 15 years of investing ahead of you, and you’ve got plenty of assets to see you through that time. The dividends from your shares should keep coming, regardless of what the markets are doing. Just make sure you always hold enough in the cash-type asset class, either inside or outside super, so you’re never forced to dump quality assets when the market is going through one of its inevitable downturns. And remember—nobody can accurately and consistently predict where markets are heading.

And finally

EMBARRASSING MEDICAL SITUATIONS

Image by mdjaff on Freepik

A man comes into the ER and yells…

“My wife’s going to have her baby in the cab.”

I grabbed my stuff, rushed out to the cab, lifted the lady’s dress and began to take off her underwear.

Suddenly I noticed that there were several cabs and I was in the wrong one.

Submitted by Dr. Mark MacDonald, San Francisco

At the beginning of my shift I placed a stethoscope on an elderly and slightly deaf female patient’s anterior chest wall.

“Big breaths,” I instructed.

“Yes, they used to be,” replied the patient.

Submitted by Dr. Richard Byrnes, Seattle, WA

One day I had to be the bearer of bad news when I told a wife that her husband had died of a massive myocardial infarct.

Not more than five minutes later, I heard her reporting to the rest of the family that he had died of a “massive internal fart.”

Submitted by Dr. Susan Steinberg

During a patient’s two-week follow-up appointment with his cardiologist, he informed me, his doctor, that he was having trouble with one of his medications.

“Which one?” I asked.

“The patch… The nurse told me to put on a new one every six hours and now I’m running out of places to put it!”

I had him quickly undress and discovered what I hoped I wouldn’t see.

Yes, the man had over fifty patches on his body!

Now, the instructions include removal of the old patch before applying a new one.

Submitted by Dr. Rebecca St. Clair, Norfolk, VA

While acquainting myself with a new elderly patient, I asked,

“How long have you been bedridden?”

After a look of complete confusion she answered…

“Why, not for about twenty years — when my husband was alive.”

Submitted by Dr. Steven Swanson, Corvallis, OR

AND ONE MORE…

Baby’s First Doctor Visit

This made me laugh out loud.

I hope it will give you a smile!

A woman and a baby were in the doctor’s examining room, waiting for the doctor to come in for the baby’s first exam.

The doctor arrived, and examined the baby, checked his weight, and being a little concerned, asked if the baby was breast-fed or bottle-fed.

“Breast-fed,” she replied…

“Well, strip down to your waist,” the doctor ordered.

She did. He pinched her nipples, pressed, kneaded, and rubbed both breasts for a while in a very professional and detailed examination.

Motioning to her to get dressed, the doctor said,

“No wonder this baby is underweight. You don’t have any milk.”

“I know,” she said, “I’m his Grandma. But I’m glad I came.”

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker