What is Financial Crime and How Do Banks Fight It? – By Neil Jayasekera

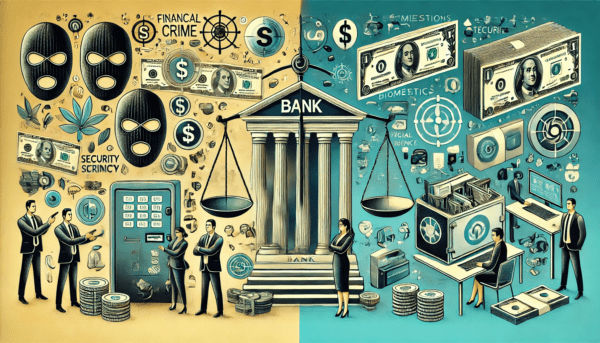

Financial crime isn’t just a headline—it’s a real problem that affects economies, institutions, and individuals alike. Think fraud, money laundering, tax evasion, bribery, and even terrorist financing. It’s all about using (or abusing) money for illegal gain.

But how do banks stop this? Turns out, banks are at the frontline in this battle, with some pretty cool tech and solid regulations backing them up.

Examples of Financial Crime

- Fraud – Like identity theft or those pesky phishing scams in your inbox.

- Money Laundering – Cleaning “dirty” money by moving it through legitimate channels.

- Tax Evasion – Hiding income or assets to dodge paying taxes.

- Bribery & Corruption – Unfairly influencing decisions by trading cash or Favors.

- Terrorist Financing – Funding dangerous activities, often disguised as ordinary transactions.

- Insider Trading – Using secret stock market info to make sneaky profits.

How Do Banks Keep Crime Out?

Banks don’t just sit back and hope for the best—they’ve got a whole arsenal of tools and strategies to tackle financial crime:

Anti-Money Laundering (AML):

- Keeping an eye on transactions to spot anything shady.

- Filing suspicious activity reports (SARs) when something smells fishy.

Know Your Customer (KYC):

- Verifying who’s opening an account and understanding what they do with it.

- Makes it harder for criminals to slip through.

High-Tech Monitoring:

- AI and machine learning spot patterns that scream “fraud”.

- Biometric tools, like fingerprint or face ID, add extra security.

Sanctions Screening:

- Banks compare transactions to lists of people or countries they must avoid (looking at you, OFAC and UN sanctions).

Australian Regulations on Financial Crime

Here’s how we tackle it Down Under:

- AML/CTF Act 2006 (shout-out to AUSTRAC for the oversight):

- Banks must have programs to detect suspicious behaviour, verify IDs, and report dodgy transactions.

- Criminal Code Act 1995: For dealing with heavy stuff like terrorist financing.

Challenges Banks Face

Of course, it’s not all smooth sailing:

- Massive Volume: Banks process millions of transactions daily—imagine keeping an eye on them all!

- Shifting Tactics: Criminals are creative, constantly coming up with new schemes (crypto scams, anyone?).

- Regulations Everywhere: Different rules across the globe mean banks have a LOT to juggle.

Why Should You Care?

Financial crime drives up costs (yes, for you too) and fuels problems like corruption and terrorism. It’s why banks invest so much in technology and compliance to keep the financial world safe.

How Can You, as a Consumer, Help Banks Fight Financial Crime?

Preventing financial crime isn’t just a bank’s responsibility—it’s a shared effort, and as consumers, we can play a vital role in protecting our financial systems. Here’s how:

- Stay Informed

- Learn to recognize common scams like phishing emails, fake websites, and phone calls claiming to be from your bank.

- Be cautious of unsolicited requests for sensitive information like your passwords or financial details.

- Secure Your Accounts

- Use strong, unique passwords for all financial accounts.

- Enable two-factor authentication (2FA) for added security.

- Regularly monitor your bank statements for any unauthorized transactions.

- Report Suspicious Activity

- If you notice unusual activity on your account or receive suspicious messages, report it to your bank immediately.

- Flag phishing emails or scam messages to help the bank track and mitigate fraudulent activities.

- Verify Before You Act

- Always double-check the identity of individuals or businesses you’re transacting with, especially for large transfers.

- Avoid sharing sensitive information over unverified phone calls or emails.

- Protect Your Personal Information

- Shred old financial documents and avoid sharing personal details on unsecured platforms.

- Keep your devices updated to safeguard them against malware or hacking attempts.

- Practice Caution with Digital Transactions

- When shopping or banking online, ensure websites are secure (look for “https” in the URL).

- Avoid using public Wi-Fi for financial transactions unless you’re using a secure Virtual Private Network (VPN).

- Support Transparency

- If you run a business, follow compliance rules like proper documentation and source verification to prevent being an unintentional party to financial crime.

By staying vigilant and proactive, you’re not just safeguarding your own finances—you’re helping the entire banking system stay more secure. Together, we can create an environment where financial crime finds no room to thrive!

Let me know if this was insightful—or if you’ve got stories or thoughts about financial crime, drop them below! Let’s talk.